US Inflation Reaches 2.7% in November Amid Slowing Economic Growth

US Inflation Hits 2.7% in November as Economic Growth Slows

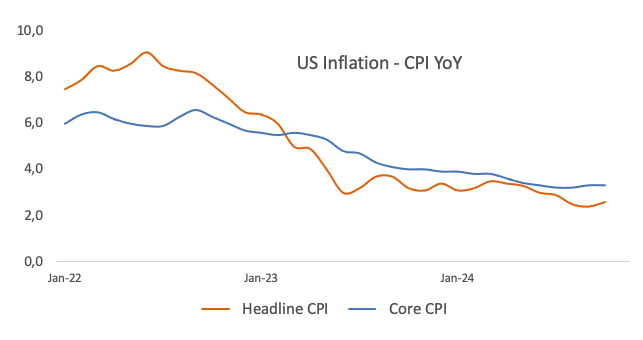

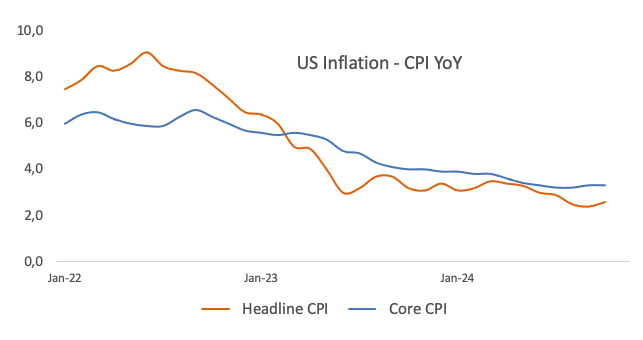

In November 2023, US inflation climbed to 2.7%, signaling a shift in the nation’s economic trajectory. While inflation remains relatively moderate compared to its peak in 2022, this uptick comes at a time when economic growth is showing signs of slowing. The 2.7% inflation rate is a key indicator, raising concerns about future price stability and the challenges ahead for both consumers and policymakers.

This rise in inflation marks a departure from the trend of decreasing prices seen earlier in the year. It also signals that the Federal Reserve’s ongoing efforts to control inflation through interest rate hikes might be facing new challenges.

What’s Driving the Increase in Inflation?

The primary drivers behind the rise in US inflation include rising energy prices, wage increases, and persistent supply chain disruptions. After a period of lower gas prices, energy costs are once again climbing, contributing to the overall inflation figure. Gasoline prices alone have added a significant strain to household budgets.

Moreover, wages have been rising steadily in certain sectors, which can result in higher costs for businesses. These increased labor costs are often passed on to consumers through price hikes on goods and services. At the same time, ongoing supply chain issues continue to affect industries, leading to shortages and further price pressures.

The housing market also plays a critical role, with home prices continuing to rise in many parts of the country. As the cost of living increases, households are finding it more challenging to make ends meet, especially with costs climbing across multiple sectors.

How 2.7% Inflation Affects Consumers

For American consumers, the 2.7% rise in US inflation means that everyday goods and services are becoming more expensive. This includes higher costs for groceries, transportation, and healthcare. While inflation at 2.7% is manageable compared to last year’s highs, it still represents a notable increase in the cost of living.

This ongoing inflationary pressure also has an impact on personal savings and investments. As inflation rises, the real value of money declines, which can erode the purchasing power of savings, especially for those on fixed incomes or retirees relying on interest income.

Additionally, inflation can lead to increased interest rates as the Federal Reserve takes action to slow the economy. This could affect consumers’ ability to borrow money affordably, making mortgages, car loans, and credit card payments more expensive.

Federal Reserve’s Response to Rising Inflation

The Federal Reserve has been closely monitoring US inflation and adjusting its monetary policy accordingly. Throughout 2023, the central bank raised interest rates in an attempt to control inflation. However, with inflation remaining above the Fed’s target rate, there is speculation that more rate hikes could be on the horizon.

If inflation continues to climb, the Fed may further tighten monetary policy, raising interest rates to slow down consumer spending and business investment. While this may help reduce inflation, it could also slow down economic growth, leading to a delicate balancing act for the central bank.

The Broader Economic Outlook

The rise in US inflation to 2.7% in November also signals a potential deceleration in overall economic growth. While inflation is still below the alarming levels seen in 2022, the combination of rising prices and slowing growth suggests that the U.S. economy could face headwinds in the near future.

In the face of these challenges, consumer confidence could be affected, and businesses may become more cautious about expanding. Rising borrowing costs may further dampen consumer spending, potentially leading to a cooling in demand across multiple sectors.

The situation is further complicated by global economic uncertainties. Trade tensions, geopolitical instability, and ongoing supply chain challenges continue to pose risks to the U.S. economy. These factors could exacerbate inflation or delay recovery in key industries.

Conclusion: What’s Next for the U.S. Economy?

As US inflation hits 2.7% in November, the outlook for the U.S. economy remains uncertain. While this inflation rate is manageable, it still presents challenges for consumers and policymakers alike. The Federal Reserve will likely continue to adjust interest rates in an effort to keep inflation under control. However, as inflation pressures persist and economic growth slows, it’s clear that the road ahead will require careful navigation.

The key to maintaining economic stability will lie in balancing inflation control with the need to support economic growth. How the Federal Reserve responds to these inflationary pressures in the coming months will be crucial in shaping the U.S. economy’s trajectory in 2024.