Inflation Control Efforts Face Stagnation Amid Economic Challenges

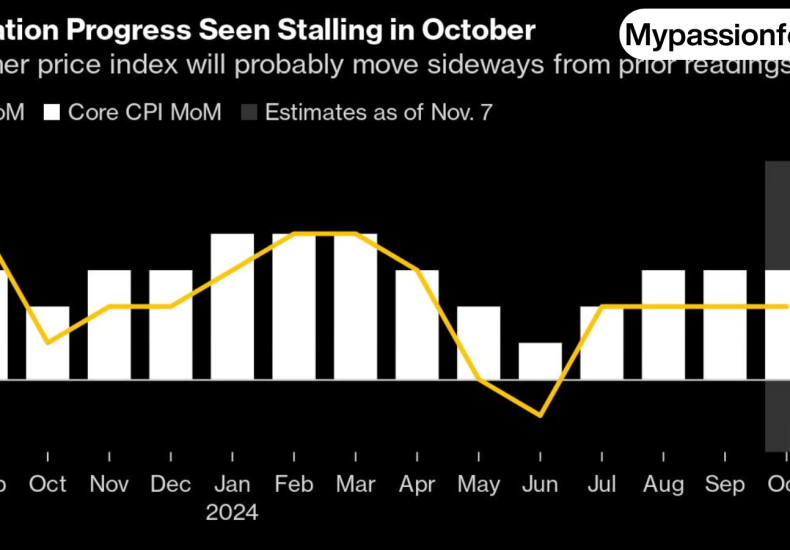

After months of aggressive measures to curb inflation, it appears that the battle to bring prices under control has hit a pause. With economic challenges mounting, progress on inflation has stalled, raising concerns about the effectiveness of current policies. While inflation had shown signs of easing earlier in the year, recent data suggests that the gains made may be temporary, with core inflation remaining stubbornly high.

What’s Driving Inflationary Pressures?

Several factors are contributing to this stagnation. Supply chain issues, which initially fueled the inflation surge, have only partly resolved. Although the global supply chain has improved compared to its worst points during the pandemic, disruptions in certain sectors persist, keeping the cost of goods elevated. Additionally, fluctuating energy prices continue to impact inflation, as any increase in fuel costs can have a ripple effect across various industries.

Demand also remains high for certain products and services, putting upward pressure on prices. With consumers still spending at a steady pace, businesses have not felt a significant need to lower prices, which has kept inflation more resilient than policymakers had hoped. This dynamic creates a tricky situation for regulators, who must balance stimulating economic growth with the need to stabilize prices.

The Federal Reserve’s Role and Its Limits

The Federal Reserve has been at the forefront of the anti-inflation efforts, primarily through interest rate hikes. Raising interest rates is designed to cool demand by making borrowing more expensive, theoretically leading to reduced spending and investment. However, these rate increases take time to show results, and the economy’s response has been mixed. While certain sectors, such as housing, have seen some slowing as a result, overall consumer demand has remained relatively strong.

There’s also the risk that continually increasing interest rates could tip the economy into a recession. If this happens, the resulting job losses and reduced consumer confidence could curb inflation, but at a significant cost. Thus, the Fed’s options are limited; it must tread carefully to avoid triggering a downturn while still attempting to manage inflation.

Why Inflation Might Remain High for Longer

Economists are now suggesting that the U.S. could be entering a period of “sticky” inflation, where inflation rates decline but at a much slower pace than anticipated. In a “sticky inflation” scenario, prices remain high for prolonged periods due to entrenched economic conditions and consumer behaviors. Factors such as wage growth, which has outpaced productivity in some industries, can contribute to sustained inflation, as businesses often pass on increased labor costs to consumers.

Geopolitical tensions also play a role, especially in commodity markets. For example, any disruptions in oil supply due to international conflicts can instantly drive up energy prices, affecting a broad range of goods and services. Given the interconnected nature of today’s global economy, these external factors are harder to control, adding another layer of complexity to inflation management.

What Does This Mean for Consumers?

For everyday consumers, stalled progress on inflation means that the prices of essentials like food, energy, and housing may remain elevated for the foreseeable future. Households may have to continue adjusting their budgets, seeking ways to cut costs or increase their income to keep up with rising expenses. Additionally, if interest rates remain high, borrowing for major purchases, such as homes or vehicles, will also be more expensive, potentially delaying these investments.

Consumers may find some relief in targeted government policies, such as temporary subsidies or tax breaks, but these are short-term fixes. The underlying inflation issue requires broader, sustainable strategies to address the systemic causes that have kept prices high.

Looking Ahead: Is There Hope for Inflation Control?

While the current outlook suggests a stall in inflation control, economists remain cautiously optimistic that inflation could still trend downwards in the long term. If global supply chains continue to stabilize and energy prices remain manageable, there’s potential for inflation to decrease gradually. Moreover, if the Federal Reserve can find a balanced approach with its policies, it may still achieve its inflation targets without severely impacting economic growth.

In conclusion, while progress on inflation has stalled for now, it is not a lost cause. It may take longer than initially expected to see substantial improvements, but with careful policy adjustments and a bit of economic resilience, the fight against inflation can still yield positive results in the future.